Excellent! Why Pe Ratio Is Not Important

In the case of PE ratio the lower the PE ratio the cheaper the stock is for the buyer. One can see a lot of variation in the PE ratio of companies across sectors.

The Problem With Forward Pe Ratios Forex Trading Strategies Ratio Forextrading

So an absolute PE ratio doesnt make much sense.

Why pe ratio is not important. PE ratio can help investors in valuing the shareholding. You can use both EPS and PE ratio to compare two stocks within the same industry to make a more informed. Therefore if the stock is trading at a higher PE than the industry average you must be very cautious before investing in the stock.

Mathematically if the EPS or the denominator in the PE ratio falls below 1 the PE ratio obtained is very high. A 10000 investment would be. However you should not rely on this ratio alone to assess the financial health of a bank.

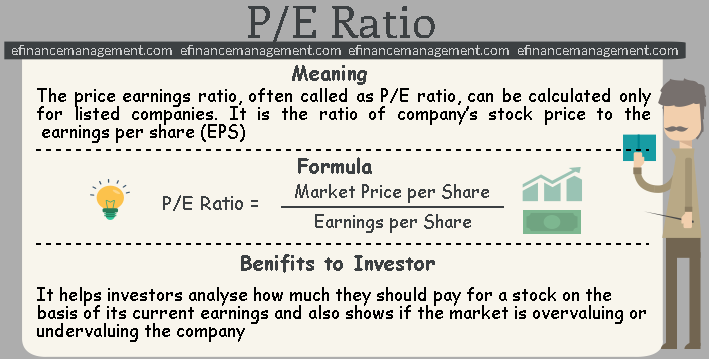

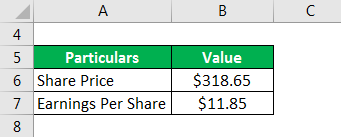

The PE ratio tells an investor what they are paying for every 1 of a company net income on a per-share basis. So PE ratio is an important aspect for valuing a company but it is also important that one doesnt look at the PE ratio in isolation. Also a PE ratio ignores a companys balance sheet and capital structure as it pertains to your investment.

A company with a high PE ratio will have to live up to the market expectation by substantially increasing its earnings or the stock price will drop. Hence you should base your investment decisions based on future earnings of the company. Is forward PE ratio more important than standard PE.

A company may have a low PE ratio for a reason that is not easily apparent. It should come as no surprise that empirical research shows accounting earnings have almost no impact on long. As a stock analysis tool the PE is often used to.

Trailing PE may not give correct picture of the companys future performance. A normal PE ratio for the market is difficult to determine. Net income is not necessarily cash flow.

Hence the sustenance of price is less likely. PS ratio Price to sales. The higher the PE ratio the higher is the risk.

This is true inspite of the fact that the investors are ready to pay more. In India FMCG companies have a much higher PE ratio when compared to other sectors. The price earnings PE ratio shows you the relationship between the price of a share and the profits the company is making.

The market condition will tame the high price and gradually will reduce the overvalued. PE ratio Price per Equity Share Earnings per Share EPS. Some analysts believe forward PE is a much indicator that PE for the following reason.

At the time the price-earnings ratio was 58. A Determinant of PE ratio. However companies trading at high PS can turn out to be great.

A low PE ratio also indicates one of. For example if investors believe a company has a poor management team too much debt or other negative factors they may be less willing to pay higher prices for its stock which would lead to a low PE ratio compared to other stocks in the same industry. The Price Earnings Ratio PE Ratio is the relationship between a companys stock price and earnings per share EPS Earnings Per Share Formula EPS EPS is a financial ratio which divides net earnings available to common shareholders by.

But more importantly the PE ratio tells you whether a share is cheap or expensive. A normal PE ratio is established for each company but it can be compared to the market PE to give some idea of risk. The higher the PB ratio more expensive is the stock and vice-versa.

When you use PB Ratio in conjunction with ROE or Return on Equity Ratio you can get a more effective analysis. Multiple of price to revenue per share of the firm. Yet had you bought shares then youd be up more than 1600 today.

You are investing for future returns. I wouldnt recommend companies trading at more than 60x PS because they carry a lot of downside with them. Generally these stocks have high potential volatility as they are overvalued.

A high PE ratio indicates one of two thingseither a companys stock is overvalued by the market or the market expects it to perform well in the future. The chain of gyms rose nearly 19 from the 1735 buy point until it started a new base. It could tell you where the share is going and where the market thinks it is going.

Its PE ratio ran as high as 299 during the last quarter of 2004. In banks the PB Ratio is the primary measure of valuation. The higher the PE ratio the more expensive the stock.

The key determinant of PE ratio is EPS. Why the PE ratio is not so important. The PE ratio is not particularly relevant as a standalone number but it is useful for comparing companies in the same industry and for determining possible entry and exit points for stocks.

Good ratio for growth stocks although the ratio itself will not tell you much about the valuation of the company. A PE of 15 indicates that investors are likely to pay 15 to receive 1 in current earnings. PB ratio compares the price of the stock with its book.

PE ratios overlook assets and liabilities that have a material impact on valuation. Beyond profitability investors are interested in knowing the value that a particular share brings to their portfolio.

P E Ratio Meaning Valuation Formula Calculation Analysis More

Coronavirus Led Panic Drives Equity Pe Ratios Down To 2012 Levels Ftse Russell

Cac 40 Share Price June 2015 The P E Ratio Of Global Stocks Have Peaked Global Stocks Global Ratio

P E Ratio Meaning Valuation Formula Calculation Analysis More

Stay Invested Earn More Mutuals Funds Finance Investing Mutual Funds Investing

Jpmorgan S Ultimate Guide To Markets And The Economy Stock Market Investing Economy

Is Negative Price To Earnings A Bad Sign For Investors Trade Brains

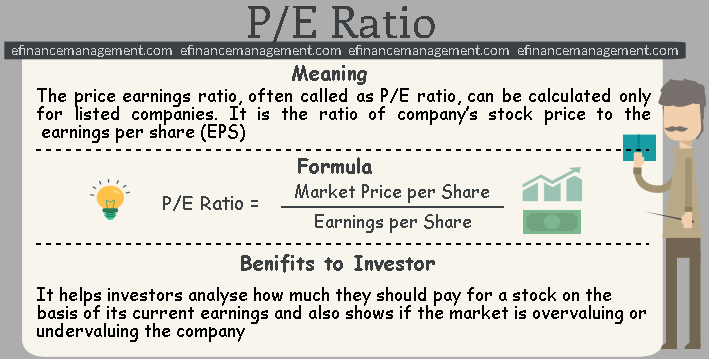

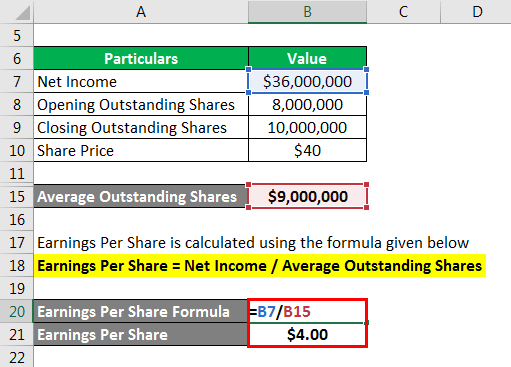

Price To Earnings Ratio Example Explanation With Excel Template

Coronavirus Led Panic Drives Equity Pe Ratios Down To 2012 Levels Ftse Russell

Thematic Investing Unlike Any Seen Before Investing Thematic Good Company

Price To Earnings Ratio Example Explanation With Excel Template

Is Negative Price To Earnings A Bad Sign For Investors Trade Brains

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Price To Earnings Ratio Example Explanation With Excel Template

What Is A Pe Ratio 2020 Robinhood

/investing4-5bfc2b8ec9e77c0026b4f956.jpg)

Price To Earnings P E Ratio Definition

Chart Showing The Development Of The P E Ratio In Comparison To The Industry Benchmark Kpi Management Infographic

Pin On Real Estate And Finance Video Tutorials

Price To Earnings P E Ratio Definition

Comments

Post a Comment