Good! Why Gst Increase In Singapore

If youre still feeling upset that GST might increase you might be comforted to know that the last GST increase was 12 years ago in 2007. Two weeks ago Finance Minister Heng Swee Keat announced in his budget speech that the Goods and Services Tax GST increase will not happen next year.

Gst Increase Here S How Much The Government Will Collect And How Much More Will You Be Paying

The increase in GST rate from 7 per cent to 9 per cent is to take place by 2025 but Mr Yip Hon Weng Yio Chu Kang asked if it could be pushed back a few years urging the Government to exercise.

Why gst increase in singapore. GST in Singapore is a broad-based value added tax levied on import of goods as well as nearly all supplies of goods and services. The GST increase supports public spending that benefits Singaporeans including better healthcare education and security. Offset package to help Singaporeans adjust to the GST increase.

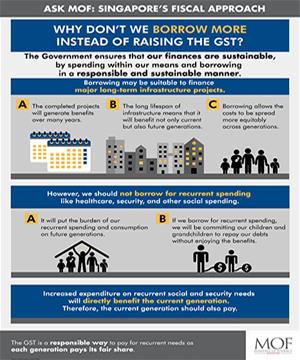

The clothes are so much cheaper compared to Singapore that you wont feel like shopping in retail malls anymore. To manage the impact of GST we absorb GST for publicly subsidised healthcare and education. If Singapore chose to draw more from its reserves as some have proposed instead of raising the tax it would gradually eat away the base of its future investment returns.

2 It is a multi-stage tax that is collected at every stage of the production and distribution chain. The only exemptions are for the sales and leases of residential properties importation and local supply of investment precious metals and most financial services. This comes as the Governments spending on healthcare infrastructure.

WHY IS SINGAPORE RAISING THE GST. After reviewing national revenue and expenditure projections and considering the current state of the economy the Government decided that the GST rate increase will not take effect in 2021. Thus the GST increase will still be needed by 2025.

SINGAPORE The Goods and Services Tax GST will be raised from 7 to 9 per cent some time between 2021 and 2025 Finance Minister Heng Swee Keat announced on Monday Feb 19 in his Budget speech. Singapore The planned increase in the Goods and Services Tax GST is set to happen by 2025 as it cannot be put off indefinitely said Deputy Prime Minister and Finance Minister Heng Swee. Late last year the Singapore government announced plans to raise GST by 2 percentage points.

The first such move in a decade as the cash-rich government cited. Why do we need to pay GST. However as indicated in Budget 2020 Singapore will not be able to put off the increase indefinitely.

The increase in GST from seven to nine per cent is expected to initially provide additional S32 billion to the budget. To ensure that Singapores tax system remains fair and resilient in a digital economy GST on imported services will be introduced with effect from 1 Jan 2020. In fact it creates a stronger Singapore at the expense of average Singaporeans who will shoulder the heaviest burden of this tax hike.

Singapore to raise GST for first time in decade despite surplus but taxpayers wont feel pain for at least three years. 1 It was introduced in Singapore on 1 April 1994 at the rate of 3 percent. The GST tax increase will keep Singapore resilient meaning competitive and fiscally sound but it is neither fair nor progressive.

Export of goods and international services are. Its society is aging and the proportion of older people will only increase increasing the pressure on the provision of health services and financial assistance in retirement. In addition the GST voucher scheme will also be enhanced once the increase takes place.

At 9 GST Singaporeans would be paying 12420 in total GST on average a month which represents a 2760 increase a month and a 33120 increase over an entire year. Basically he is indirectly telling us that if we are hoping that they will scrape the plan to increase GST we can forget about it lah. In addition the GST Voucher scheme helps lower- and middle-income Singaporeans to offset part.

It was then increased to 4 percent from 1 January 2003 5 percent from 1 January 2004 and 7 percent from 1 July 2007. If you want to find out how much more GST youll be paying as a result of the rate hike you can track your expenses over a month. THE Singapore government will not be raising the Goods and Services Tax GST in 2021 but will defer the increase to some time between 2022 and 2025 instead Deputy Prime Minister and Finance Minister Heng Swee Keat said in his Budget speech on Tuesday.

The Goods and Services Tax GST hike which was announced in 2018 is needed to support structural increases in healthcare spending as well as other needs like pre-school education. GST INCREASE 2022-2025 I do not doubt that we would need more tax revenues in the near-future for two reasons. The Goods and Services Tax GST is a tax on domestic consumption.

A previously announced increase in the Goods and Services Tax GST will not take place next year said Deputy Prime Minister Heng Swee Keat during his Budget 2020 speech on Tuesday. But why does the government not even have to raise the GST in the first place. Goods and Services Tax Abbreviation.

One GST increase was already planned as we expect an increase in expenditure from. SINGAPORE - The goods and services tax GST is set to increase from 7 per cent to 9 per cent some time between 2021 and 2025. Singapore may be very well governed but it is not immune to demographic changes.

Such a scheme according to Heng has helped to ensure that Singapore is able to provide targeted help to. For the import of goods there will be international discussions on how GST can apply before deciding on the measure to. SINGAPORE - In his Budget round-up speech on Friday Feb 28 Deputy Prime Minister Heng Swee Keat set out in detail why the planned goods and services GST tax hike cannot be delayed or dropped.

In the Singapore Budget 2018 the next proposed GST increase will happen between 2021 and 2025 from the current rate of 7 to 9In the recent Singapore Budget 2019 delivered by Finance Minister Mr Heng Swee Keat a similar stance was reiterated but the. INCREASE IN GST.

Possible Impact Of Gst Hike In Singapore

Singapore Budget 2018 Gst To Be Raised From 7 To 9 Some Time Between 2021 And 2025 Singapore News Top Stories The Straits Times

Gst Increase Here S How Much The Government Will Collect And How Much More Will You Be Paying

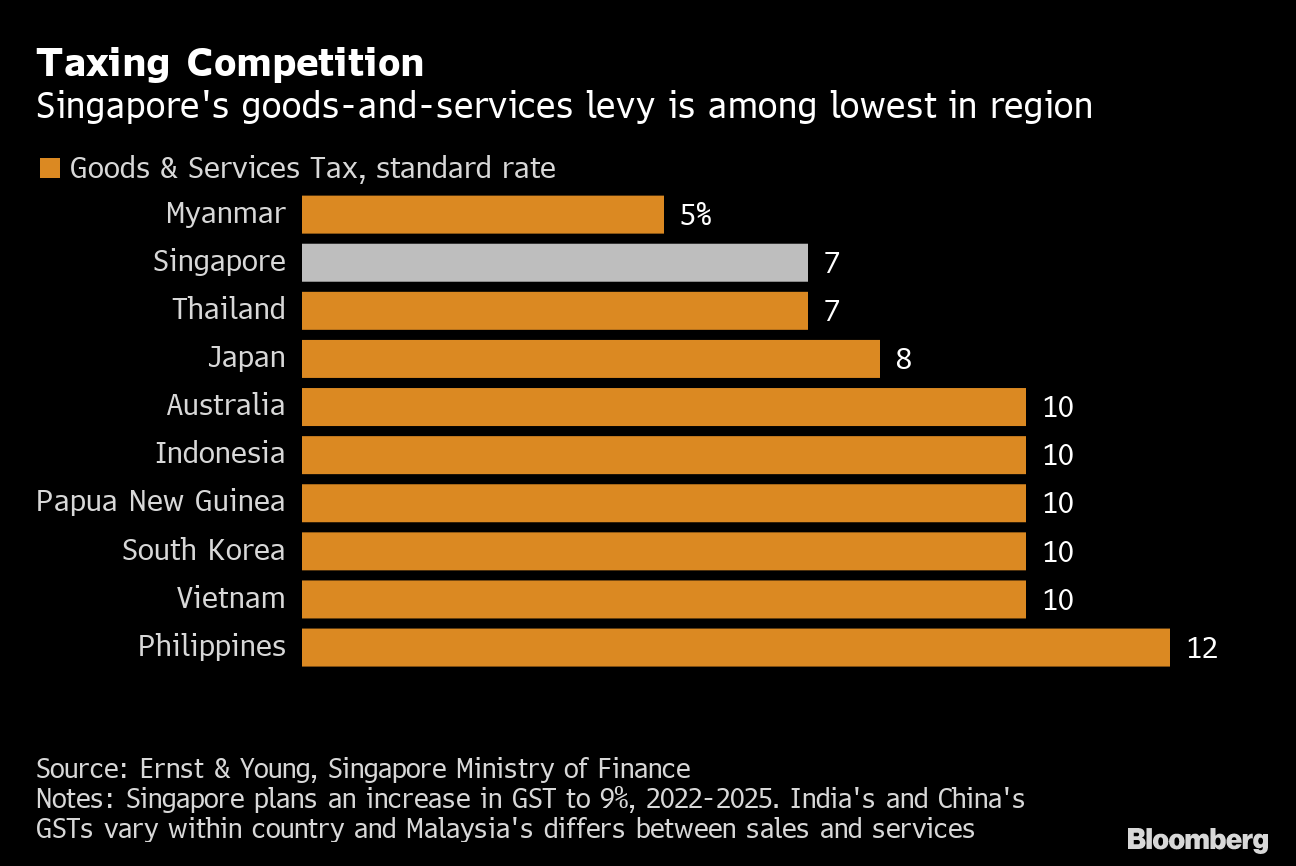

Countries With A Lower Gst Than Singapore

Singapore To Increase Gst Rate

Why Singapore Should Raise Gst To 9 As Early As Possible

Singapore Gst Goods Services Comprehensive Tax Guide

Why Singapore Should Raise Gst To 9 As Early As Possible

Singapore Budget 2018 Gst To Be Raised From 7 To 9 Some Time Between 2021 And 2025 Singapore News Top Stories The Straits Times

Singapore Boosts Spending To Counter Virus Economic Threats

Gst Singapore A Complete Guide For Business Owners

Singapore Budget 2018 Gst To Be Raised From 7 To 9 Some Time Between 2021 And 2025 Singapore News Top Stories The Straits Times

Budget 2021 Gst Will Be Charged On All Overseas Online Shopping From Jan 2023 Blog Youtrip Singapore

Gst Increase Here S How Much The Government Will Collect And How Much More Will You Be Paying

Singapore Gst Goods Services Comprehensive Tax Guide

Gst Increase Here S How Much The Government Will Collect And How Much More Will You Be Paying

Gst Singapore A Complete Guide For Business Owners

Comments

Post a Comment