OH MY GOD! Why Would A Bank Reject A Wire Transfer

A wire transfer can be stopped as well but only if the buyer acts quickly. Its almost assuredly better than sending the money somewhere else yourself as many scammers would want you to do.

How To Do A Free Wire Transfer

Hard to verify recipient.

Why would a bank reject a wire transfer. We do not charge for failed or canceled transfer requests. In some cases an underlying transaction may be prohibited but there is no blockable interest ie that of a Specially Designated National SDN or blocked person or government in the transaction. ACH transfers are not acceptable for escrow purposes because they can be revoked so the escrow companys bank may automatically reject the transfer thereby jeopardizing the transaction.

In these cases the transaction is simply rejected or. A bank always has the right to refuse to execute or receive a wire transfer. She is recovering from double knee replacement and unnessarily closing her account precludes her paying her bills.

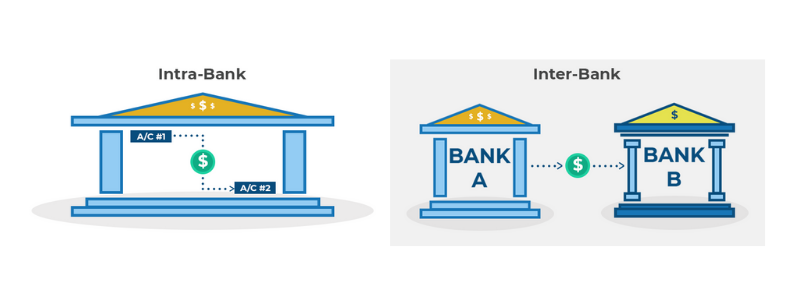

Why was my wire rejected. What is the difference. There are many reasons why the bank may refuse most of them involving potential fraud.

For a transfer into our system that was rejected by the Registrar of Record please contact that registrar. I already sent my wire transfer report to president of international banking division of scotiabank thats why they replied with investigation report that my wire transfer is rejected. There are many reasons why the bank may refuse most of them involving potential fraud.

This customer had a wire come in yesterday and is now requesting an international wire. In most cases a wire is declined because there is some issue missing information. My question is can bank correct the info and send it again in one day.

If you are talking about receiving banks then there can be many reasons for an international wire transfer to be declined. If a bank transfer is rejected the funds will be returned to your Balance. In short no you cannot reverse a wire transfer once the funds hit the beneficiary account if no extenuating circumstances surround the erroneous transfer.

It could be because you entered a wrong account number IBAN or SWIFT number. If you wire money to a stranger or use a business that pays out cash such as a retail money transfer shop or Western Union it is harder to verify who got the money. Or it could also be because you dont have sufficient funds in your account.

Banks and other wire transfer institutions generally address the senders liability if they provide the wrong account information or end up erroneously wiring money to a scammer. Action on an Intl bank then that money in the wire account will be gone within a few minutes. Most commonly the term wire transfer refers to bank wires which transfer.

It is theoretically possible but highly unusual for a bank to refuse to accept an incoming wire transfer because the recipients account is overdrawn. However the bank did not bring up exact reasons and did not say anything about the other side being able to reverse dip into the banks wire account. I went too 3 other banks today and they said the exact same thing one bank even turned me down for.

I dont know about Ukraine specifically but in general yes it should be possible to reject a deposit but you would have to get in touch with your bank to do so. Wires are returned for the following reasons. In my experience this is the most common reason for a wire-transfer to be rejected.

If you made a transfer and it failed to go through or you discover that it is being delayed dont hesitate to contact your bank ASAP to resolve the issue. It is theoretically possible but highly unusual for a bank to refuse to accept an incoming wire transfer because the recipients account is overdrawn. Up to 20 cash back Chase bank refused to process a 25K wire transfer and accused my Fiancé of fraud money laundering froze her account and threatened to report her to credit agencies.

Transfers can be arranged online by phone in person or with a mobile app. Bank account name on wire does not match the Gemini account holders name. A wire transfer is a term that describes the electronic transfer of money.

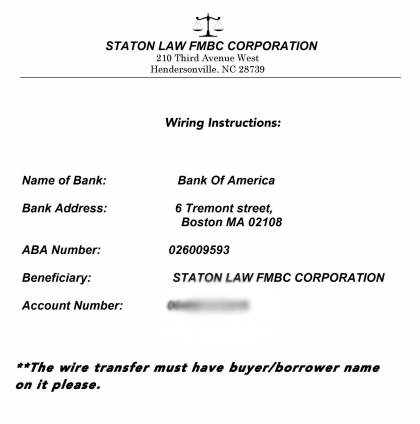

The sending bank account is not registered to your Gemini account. If a user omits or incorrectly enters a digit for their account or routing number when requesting a transfer to bank the request may pass the 5miles validation check but be rejected by the designated financial institution. Wrong information etc with the beneficiary account.

We do not have access to the reasons the current registrar has rejected your transfer request. Usually a wire transfer is rejected due to missing or incorrect information such as the account holders name or account number. It is theoretically possible but highly unusual for a bank to refuse to accept an incoming wire transfer because the.

Other reasons to reject a transfer include the sender or recipient being listed on the governments OFAC office of foreign asset control list of suspected terrorists which requires the bank to block the transaction. Nonbank wire transfers can be pricey but offer convenience if a bank wire transfer isnt a good option for you. Receiving banks can sometimes reject a transfer for a number of reasons like incorrect recipient details closed accounts or others.

If a receiving bank rejects your transfer you have two options. A bank always has the right to refuse to execute or receive a wire transfer. A seller generally will accept a wire transfer as a safer form of receiving money than a check which can be denied due to a stop payment order or insufficient funds in the buyers account.

Someone with a fake ID could collect the cash and it may be hard to track the recipient. The account number on wire transfer does not match the bank account registered to your Gemini account. I gave her the funds from my nonChase savings.

Do we as a bank have the right to refuse a wire transfer request if we feel it is suspicious and unusual activity for a particular customer. Right to Refuse Wire Transfer- Unusual Activity. You can either correct the issues found by the receiving bank and resend the funds.

A bank always has the right to refuse to execute or receive a wire transfer.

Wire Transfers Explained 10 Things You Need To Know Remitr

How To Wire Transfer Money 6 Steps With Pictures Wikihow

Wells Fargo Wire Transfer Fees And Instructions

Wire Transfers International Bb Americas Bank

Wire Transfers Explained 10 Things You Need To Know Remitr

7 Essential Qualities To Look For When Choosing Wire Transfer Software

Wire Transfer Confirmation Email Lead To Malware Microsoft Word Format Words Email Leads

How Wire Transfer From India To Abroad Actually Works Extravelmoney

Blind Trust In Email Could Cost You Your Home Krebs On Security

Can You Reverse A Wire Transfer Laws101 Com

Wire Transfers International Bb Americas Bank

Wire Transfers International Bb Americas Bank

Td Ameritrade Wire Transfers And Ach 2021

Processing International Funds Cornell University Division Of Financial Affairs

How To Wire Transfer Money 6 Steps With Pictures Wikihow

How To Wire Transfer Money 6 Steps With Pictures Wikihow

Wire Transfers Explained Outdated Overpriced Save Money With Veem

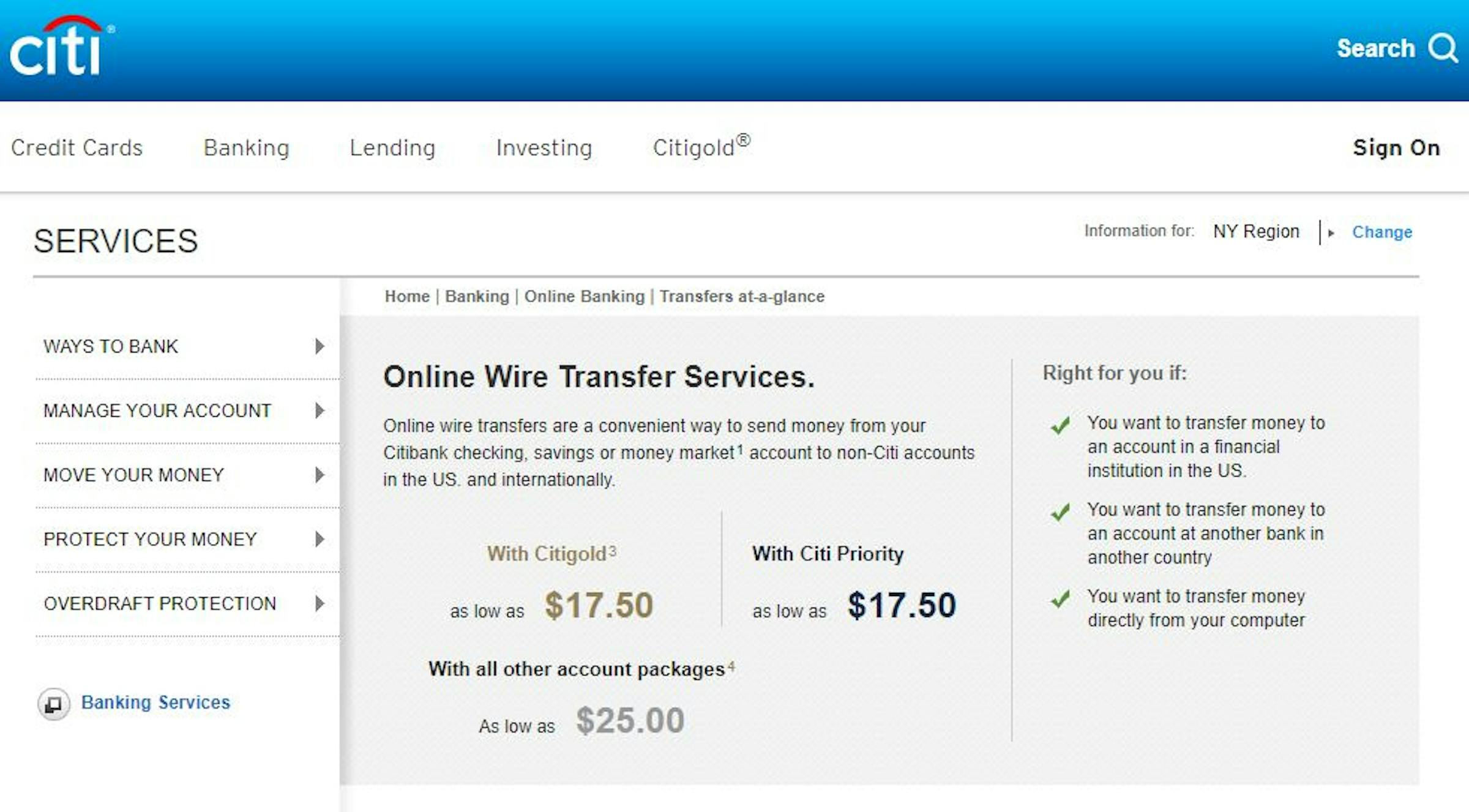

Citibank Foreign Currency Exchange International Wire Transfer Atm Fees Explained

Comments

Post a Comment